Medical Cost Transparency: All You Need Are Night Goggles And A Crash Course In Computer Programing

By: Staci Cassidy, J.D., Senior Vice President, PartnerSource

Since medical incurred for treatment is a primary measure of damages in a suit for negligence, it is not uncommon for plaintiff attorneys to submit unreasonably high medical charges as a way to obtain a higher payout.

Two recent federal rules, the Hospital Price Transparency Rule and the Transparency in Coverage Rule, could assist in valuing the reasonable cost of incurred medical in the context of a tort allegation. Can these new hospital transparency rules help an employer defendant combat inflated medical charges?

As a reminder, the federal Hospital Price Transparency Rule requires hospitals to provide clear, accessible pricing information online about the items and services they provide in two ways:

- As a comprehensive, machine-readable, file with all items and services.

- In a display of shoppable services in a consumer-friendly format. [i]

The Transparency in Coverage Rule requires group health plans and health insurance issuers in the individual and group markets to disclose in-network provided negotiated rates, historical out-of-network allowed amounts, and drug pricing information through three machine-readable files posted on an internet website.[ii]

Therefore, instead of having to initiate discovery against a particular medical provider to provide its “list prices,” cash discount rates and contractually negotiated rates with various health plans in an effort to get to a medical cost that is reasonable, these recent federal rules should enable us to obtain that data from the providers and health plans directly from their website! #mindblown #can’twaittotryit.

But wait. If anyone has ever had a so-called friend give her a scratch-off lottery ticket reflecting she won millions only to read (after jumping up and down in excitement for several minutes) the small print revealing it’s just a joke, you know what that adrenaline drop is like – or hopefully you can imagine.

Now maybe the adrenaline drop I experienced when I excitedly set about looking up hospital after hospital’s compliance with the Hospital Price Transparency Rule was not as bad as falling for the very cruel, fake lottery ticket joke, but for me-- it was in the ballpark.

On my first several attempts to compare a particular hospital’s inflated medical invoice submitted by a claimant’s attorney in support of his six-figure-demand for a soft tissue back injury to that hospital’s own online pricing and rate data, I realized the majority of hospitals had not yet complied with the Rule’s requirement to post the data online. Before you ask, no, it was not user error.

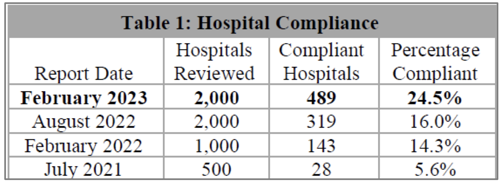

According to its Fourth Semi-Annual Hospital Price Transparency Report issued in February 2023, Patient Rights Advocate.org published the results of its latest review of 2000 hospitals’ compliance and found that only 489 hospitals (24.5%) were compliant with the Rule, which was up 8.5% from its August 2022 review.[iii]

I had better luck on my most recent attempts to review a hospital’s online data. I found the data posted, but it looked like this:

My initial reaction (after I woke up!) was frustration and skepticism that the hospitals were not making a good-faith attempt to comply with rule.

However, after a quick YouTube tutorial with “Kyle” from Web Dev Simplified entitled “Learn JSON in 10 minutes”[iv], I came to accept -- albeit grudgingly -- the explanation that because the data hospitals are required to provide online is voluminous, it is important to create it in a “data representation format” like JSON, which is reportedly lightweight and easier to write.

Once I determined I could open a JSON file on Windows 10 and 11 with “Notepad,” I was able to search the particular CPT Code and pull the relevant data some of the time.

It’s true that I experienced a little “too good to be true” reality when I first attempted to apply these two rules to specific claims, but I suspect it’s just a little too early to use this effectively. However, as hospital compliance increases, employers should be ready and know how to use these new laws to combat inflated medical charges.

At OneSource on May 31, I will be joined by Katherine Killingsworth from SettlePou for our presentation on “Inflated Medical Costs, It’s a Multi-Front Battle,” to learn more about these two transparency rules and other ways employers can defend against inflated medical billing.

___________________________________

[i] https://www.cms.gov/hospital-price-transparency

[ii] https://www.cms.gov/healthplan-price-transparency/public-data

[iii] FEBRUARY 2023 SEMI-ANNUAL COMPLIANCE REPORT — PatientRightsAdvocate.org